Inflation pricing strategy is no longer a boardroom concept for most of us in agriculture, it shows up in daily life. Rising costs are real. Materials, labor, logistics, capital, every line item feels heavier than it did a few years ago.

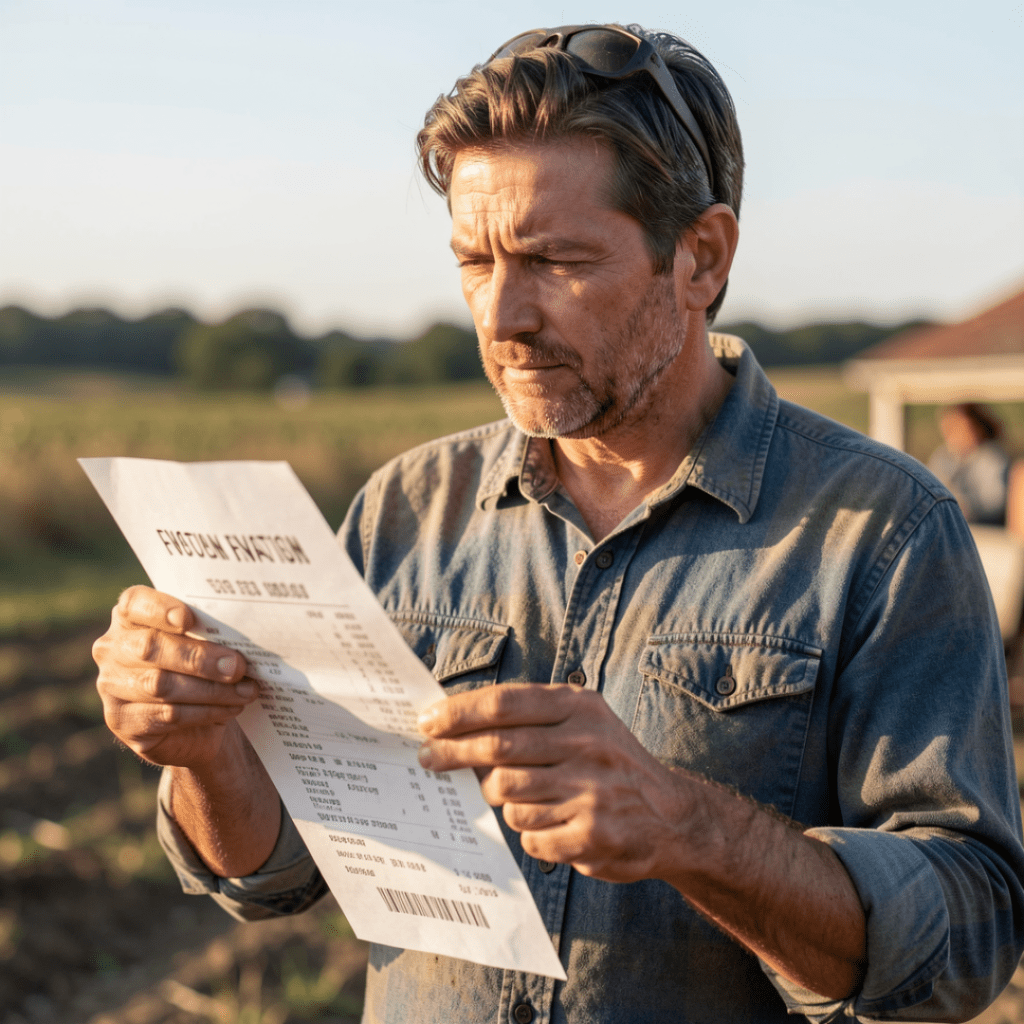

That reality hit home for me after a routine grocery run. Nothing extravagant, just a week’s worth of food. The total cleared four hundred dollars. I stopped for a second, genuinely stunned. This was right after Christmas, when budgets are already tight, and it was impossible not to think about how much pressure people are under.

Inflation is not theoretical. It is standing in the checkout line, watching the total climb. It is in the fuel bill, the machinery quote, and the interest line on your balance sheet. Farmers feel it. Manufacturers feel it. Everyone in the chain feels it.

In agriculture and manufacturing, the most obvious response is also the most common one. Costs go up, so you raise prices and move on. The spreadsheet says it is justified, and the market seems to accept it, at least for a while.

Rethinking our inflation pricing strategy at Sunnybrook

Every business has an inflation pricing strategy, even if it is simply “raise prices and move on.” This year at Sunnybrook, we decided to pause before taking that path. We chose not to raise prices.

That decision was not because our costs stayed flat. They did not. Steel, labor, freight, and financing have all climbed. Yet standing there with that grocery receipt in my hand, I kept thinking about the farmers we serve. If everyone in the chain just passes costs downstream, eventually something breaks.

So instead of pushing the entire problem onto our customers, we asked a different question. What if we protected profitability by focusing inward first? That mindset led us to treat pricing as more than math. It pushed us to treat it as a leadership decision.

Practically, that meant tighter cost controls inside our own walls. We looked harder at waste, efficiency, and process. It meant stronger conversations with suppliers and partners, sometimes uncomfortable ones. It meant more discipline in how we plan production, manage inventory, and schedule logistics so we can stretch every dollar further before it ever lands on a farmer’s invoice.

Leading with farmers in mind

When you decide not to raise prices in an inflationary environment, you are choosing harder work behind the scenes. You are choosing to absorb more complexity instead of exporting it. For us, that choice started with a simple belief, farmers should not always be the shock absorber for everyone else’s decisions.

Because of that belief, we challenged ourselves to find value before we changed a price list. Where could we be sharper in operations? How could we improve communication with dealers so parts flow more smoothly? Which internal habits were costing us more than they were worth?

None of this means we are against profit. We are entrepreneurs, and we believe strongly in running healthy, profitable businesses. However, we also believe that how you earn profit matters. In an inflationary economy, pricing is a test of character as much as a financial lever.

Your own inflation pricing strategy will not look exactly like ours. Every operation has different pressures, margins, and realities on the ground. Still, the question behind it is universal. Are you simply doing what is easiest, or are you doing what is right for the people who rely on you?

This was not a promise forever, and it is not a guarantee that prices will never move. Markets change, and responsible businesses have to adapt. Yet for this season, we chose intentionally to hold the line and do the hard work on our side first.

Sometimes leadership is quiet. It does not always come with a big announcement or a dramatic gesture. Often, it looks like small but costly choices that protect the people who trust you. In our case, it looks like keeping parts fairly priced while we grind away on the invisible details that make that possible.

In the end, the right inflation pricing strategy starts with a simple question: just because you can raise prices, does that mean you should? At Sunnybrook, at least for now, our answer is no.